Financial literacy links to inclusive growth, combating poverty, inequality, exclusion, and immobility, thereby accessing economic growth benefits.

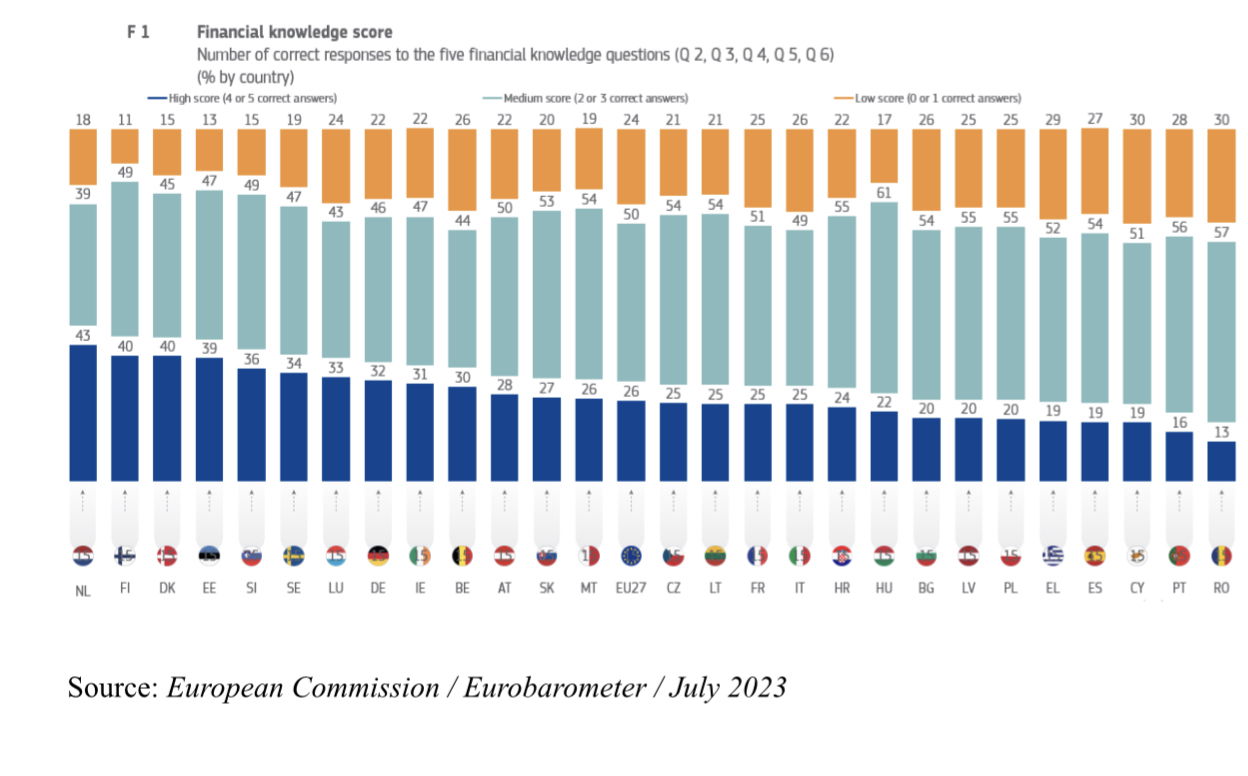

The European Commission has recently published the results of a survey on financial literacy in the European Union.

The survey tested both the financial knowledge and financial behavior (jointly considered as financial literacy) of EU citizens.

The findings indicate that within the EU populace, 18% exhibit a strong grasp of financial literacy, 64% possess an intermediate level, while the remaining 18% demonstrate a lower proficiency.

Within the European Union, one can find both top-tier performers such as Sweden, Denmark, The Netherlands, Slovenia, and those falling beneath the global average like Romania, Portugal, Cyprus, and Spain.

What underscores the significance of financial literacy in fostering inclusive growth?

It’s widely accepted today that equipping individuals with the knowledge and resources to navigate the progressively intricate financial landscape is a fundamental requirement for achieving inclusive growth.

For the impoverished and marginalized, heightened financial literacy translates to enhanced prospects for harnessing the advantages of economic advancement.

Studies validate that individuals with lower education and income levels consistently attain lower financial literacy scores compared to the broader population.

Countries have tested diverse policies to enhance financial literacy, revealing key insights. General findings from these policies highlight the need for tailored approaches. Recommendations include:

- Early Education: Integrate financial education into school curriculums, beginning at young ages. Quality matters more than availability.

- Targeted Programs: Tailor initiatives to specific groups like youth, low-income individuals, and migrants. Private sector backing, with oversight, is essential.

- Lifelong Learning: Offer financial education before significant financial decisions. Personalized and relevant programs are crucial.

- Private-Sector Participation: Private involvement is vital but must be monitored to avoid conflicts.

- Balanced Approach: Overloading with information hinders decision-making. Best practices involve limited, relevant choices reflecting individuals' capacity and preferences.

- Behavioral Research: Long-term effects of education programs require understanding through surveys and trials. An interdisciplinary approach involving behavioral economists, sociologists, and psychologists enhances research quality.